For many families, a home isn’t just a place to live, it’s a lasting legacy. Whether it’s passed down from parents, grandparents, or another relative, inheriting a home can be one of the most meaningful and financially significant events in a person’s life. But how common is it in today’s economy?

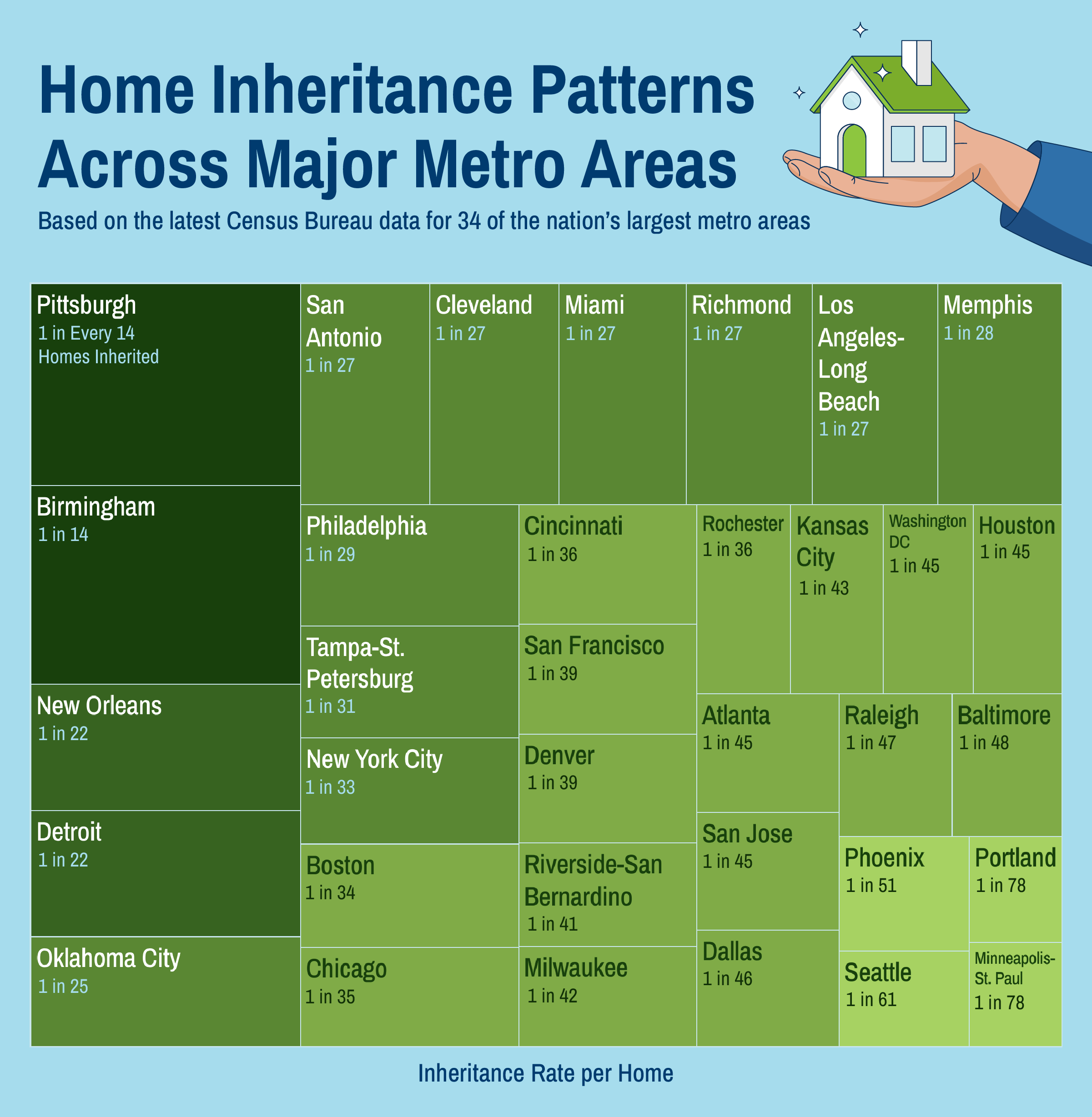

To find out, we analyzed the latest data from the U.S. Census Bureau’s American Housing Survey, focusing on 34 major U.S. metro areas. We examined the share of inherited homes in each area and the frequency of these transfers per capita.

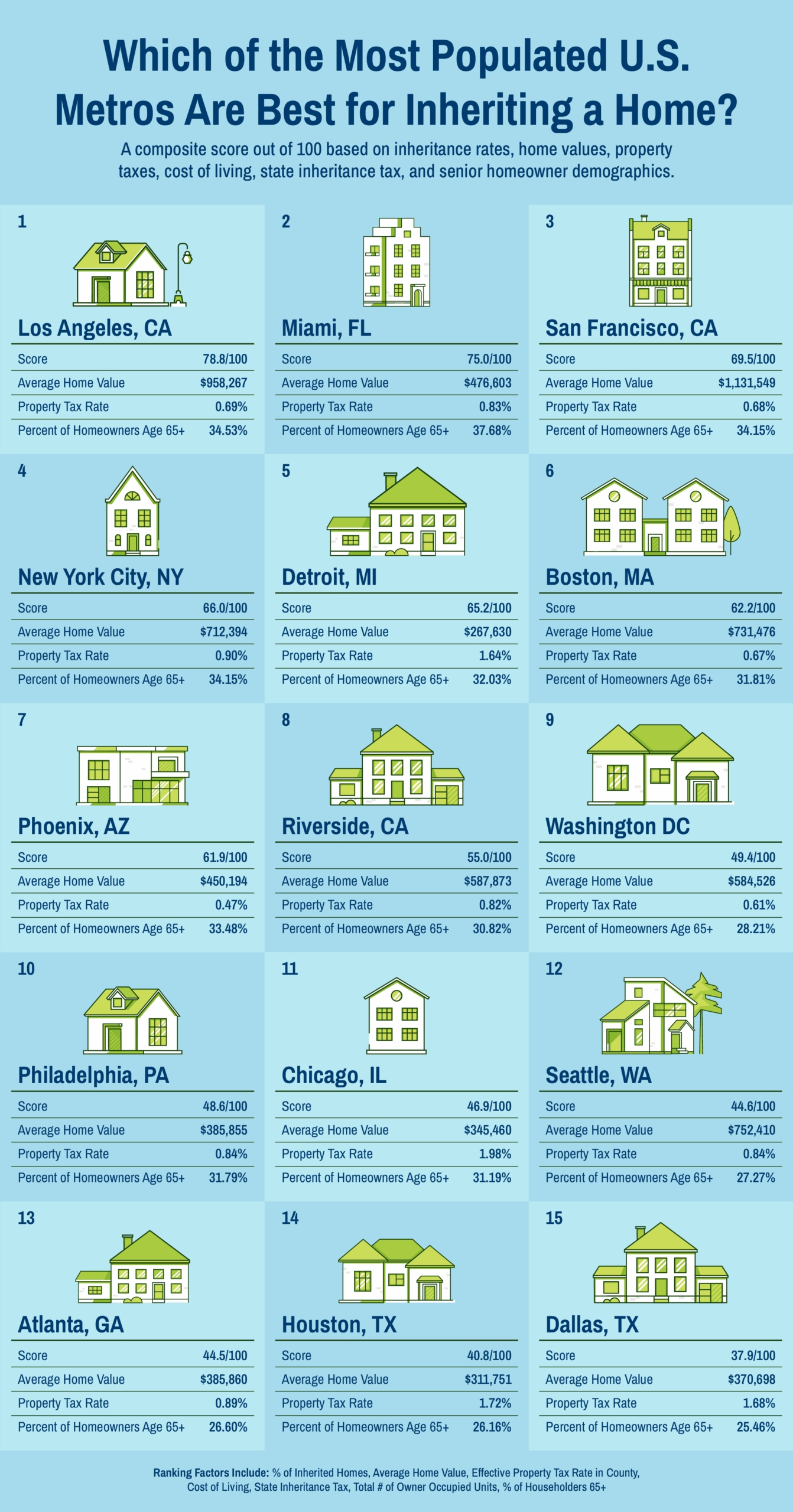

Then, we ranked the 15 largest U.S. cities by how favorable they are for inheriting a home, factoring in housing costs, tax policies, and demographic data.

Keep reading to discover where inherited homes are most common and where they may offer the biggest financial benefit.

Key Findings

- Pittsburgh and Birmingham lead the nation in home inheritance among major metro areas analyzed — over 7% of homes in each city were received as inheritance or a gift, roughly 1 in every 14 homes.

- Cities in California dominate the list of best places to inherit a home, with Los Angeles, San Francisco, and Riverside all ranking in the top 10 based on a mix of tax friendliness, home values, and share of older residents.

- In contrast, cities like Minneapolis, Portland, and Seattle saw the lowest inheritance rates — less than 2% of homes were passed down, or just 1 in every 61 to 78 homes.

In Which Cities Do Americans Inherit the Most Homes?

In Pittsburgh, inherited homes account for 7.17% of all housing — about 1 in every 14 homes. That rate is well above the national average and aligns with Pennsylvania’s broader trend, where 4.80% of homes are inherited statewide.

Cities in Florida also stood out. In Miami, 3.69% of homes were inherited, roughly 1 in every 27. That closely reflects Florida’s statewide rate of 4.10%, or 1 in 24 homes. Combined, these figures suggest that in areas with high retiree populations and long-term homeownership, the passing down of homes remains a common and impactful practice.

Other metro areas, like Los Angeles (3.64%) and New York City (3.05%), report moderate inheritance rates — but still contribute meaningfully to the broader trend. California and New York also show relatively high statewide inheritance activity, with New York seeing 4.65% of homes inherited (1 in 21), while California comes in slightly lower at 3.39% (1 in 29).

Some metros, though, show far less home inheritance activity. In Seattle and Portland, fewer than 2% of homes were inherited — about 1 in every 61 to 78. These cities may reflect more transient populations or less intergenerational property ownership, particularly in markets where high home values make it harder to retain family-held properties over time.

Which Cities Are Best To Inherit a Home?

While home inheritance occurs in many places, some cities provide a more favorable environment for it. To find out where inheriting a home might offer the biggest upside, we evaluated the 15 largest U.S. metro areas using seven key factors: the share of inherited homes, average home value, property tax rate, cost of living, state inheritance tax presence, total number of owner-occupied units, and percentage of householders age 65+.

Los Angeles and Miami topped the list with scores of 78.8/100 and 75.0/100, respectively. LA’s sky-high average home values (over $950,000) could be daunting, but its favorable property tax rate (0.69%), inheritance activity (3.64%), and large base of older homeowners (35%) make inheriting there especially valuable. Miami, while more affordable with a median home value under $500,000, stands out thanks to no state inheritance tax and the highest share of 65+ householders (38%) among the cities analyzed.

San Francisco (69.5/100) and New York City (66.0/100) also ranked highly. Their expensive real estate means an inherited home carries a significant financial impact, and relatively low property tax rates help ease the burden of keeping those properties.

Among more affordable markets, Detroit emerged as a surprise leader. With average home values under $270,000 and one of the nation’s highest inheritance rates (4.47%), it scored 65.2/100.

Cities like Boston (62.2/100), Phoenix (61.9/100), and Philadelphia (48.6/100) landed in the middle for different reasons. Boston’s pricey homes are softened by lower property taxes, while Phoenix benefits from low taxes and moderate home prices despite a below-average inheritance rate of just 1.96%.

Dallas, Houston, and Atlanta rounded out the bottom. Although all three lack a state inheritance tax and have relatively modest home values, they also have fewer older homeowners and lower inheritance activity. In Dallas, for instance, only 25.5% of householders are 65 or older, and just 2.19% of homes were inherited, reducing both the likelihood and potential payoff of passing down property.

Closing Thoughts

A home is more than just property — it often represents family history, stability, and legacy. Our analysis highlights where those legacies are most likely to be passed down, and the financial factors that make inheritance more or less favorable across U.S. cities.

At Coventry Direct, we understand the importance of planning for the future and making the most of the assets families have built over time. Just as inheriting a home can create new opportunities, accessing the value of a life insurance policy you no longer need can provide financial flexibility for today and tomorrow.

Methodology

To uncover where Americans are most likely to inherit a home, we analyzed the most recent data available from the American Housing Survey (AHS). This dataset includes inheritance information for 34 of the nation’s largest metropolitan areas. For each location, we calculated both the share of homes acquired through inheritance or gift and the inheritance rate, expressed as “1 in every X homes.”

Beyond this, we created a ranking of the top 15 U.S. cities by metropolitan statistical area (MSA) to evaluate how favorable they are for inheriting a home. To develop the ranking, we combined six equally weighted factors into a total score out of 100. Each factor was measured at the city level whenever possible; for metrics only available at the state level (such as inheritance tax rates and property taxes), the statewide values were applied to cities within that state. This ensured consistency across locations while still capturing both local and regional conditions.

Ranking factors and data sources included:

- Number of homes acquired through inheritance or gift — American Housing Survey

- Average home value — Zillow Home Value Index

- Property tax rates — Tax Foundation

- Cost of living index — MIT Living Wage Calculator

- Inheritance and estate tax policies — Partners Financial 2025 State Estate & Inheritance Tax Chart

- Percentage of population age 65+ — U.S. Census Bureau (ACS)

Each factor was normalized on a 0–5 scale, weighted evenly, and combined into a composite score. This approach ensured that both housing market conditions and demographic factors were reflected in the final ranking.