Have your life circumstances changed since you took out your life insurance policy? Policyowners sometimes find themselves no longer wanting or needing their life insurance policy the way they once did — and that’s okay. The reason you took out a life insurance policy may no longer be applicable. Perhaps your children are grown and financially independent. Perhaps your beneficiary who depended on your salary has since passed. Or perhaps you’re reaching a point where premiums are no longer affordable. No matter your life circumstances, there are ways to end your policy and still reap the benefits of this important asset you’ve paid into for years. For many policyowners, this looks like surrendering your policy.

Have your life circumstances changed since you took out your life insurance policy? Policyowners sometimes find themselves no longer wanting or needing their life insurance policy the way they once did — and that’s okay. The reason you took out a life insurance policy may no longer be applicable. Perhaps your children are grown and financially independent. Perhaps your beneficiary who depended on your salary has since passed. Or perhaps you’re reaching a point where premiums are no longer affordable. No matter your life circumstances, there are ways to end your policy and still reap the benefits of this important asset you’ve paid into for years. For many policyowners, this looks like surrendering your policy.

The surrender of a life insurance policy involves the termination of your life insurance for a cash payout. After you surrender your policy back to the life insurance provider, you receive the cash surrender value of the policy, which is the amount the accrued within the policy that you will receive, less any applicable fees, outstanding loans, or interest owed.

If you’re considering surrendering your policy, let’s explore the reasons why people decide to surrender, what the process of surrendering looks like, and alternatives that may be more financially lucrative to surrendering your policy.

Common reasons why people surrender their life insurance policy

Surrendering a policy happens because life can be unpredictable. While most folks who take out a permanent life insurance policy — such as a whole life insurance policy or a universal life insurance policy — plan on keeping it until end-of-life so their beneficiaries can collect the death benefit, sometimes circumstances arise that require a course correction. Here are some of the most common reasons people choose to surrender their life insurance policy:

- Adult children are no longer financially dependent. If a policyowner took out a policy to protect their young children, they may find that 20+ years later their adult children no longer need the financial support upon the insured’s death.

- Their spouse has passed. Another common reason someone may surrender their policy is that their spouse has died. Typically, the breadwinner of the family may take out a life insurance policy to protect their spouse. However, if the spouse passes before the family’s breadwinner does, the policy may be unnecessary.

- Finances are tight. When a policyowner experiences decreased financial stability, they may consider surrendering their life insurance policy. If they find it challenging to pay premiums, they may give up the policy altogether and collect any cash surrender value that may have accrued.

- Better investment opportunities. For folks who use their life insurance policy as an investment vehicle, they may find that the returns of their policy’s cash value are not as favorable as an alternative investment opportunity. Instead of keeping their cash in an account with limited growth potential, they may take the cash surrender value and redirect it into investments they believe will yield higher returns.

- They need cash now. Sometimes unexpected expenses show up — healthcare bills, retirement living expenses, and long-term care costs for example. Policyowners may want to surrender their policy to pay for these unexpected financial obligations rather than wait for the death benefit to pay out to their beneficiaries later.

What happens when you surrender a life insurance policy?

Let’s walk through the steps of surrendering and what surrendering means for your life insurance coverage.

When you surrender your life insurance policy for the cash surrender value, you are essentially canceling your life insurance coverage. After you receive the cash surrender value — minus any surrender fees owed to the life insurance provider — your life insurance coverage ends. When you die, your beneficiaries will not receive the death benefit.

The process of surrendering your policy is relatively easy:

- Contact your insurance company. You can initiate the surrender process over the phone. The insurance agent will walk you through the steps and documentation required to collect any cash surrender value you may have. They can also inform you about any fees you’ll be charged.

- Submit documentation. You’ll likely need to supply a surrender request form to your life insurance provider.

- Receive cash surrender value. After the life insurance provider has processed your request, you can expect to receive the cash surrender value funds via check or electronic transfer.

- Obtain policy termination confirmation. Upon receiving the cash surrender value, expect to receive a confirmation of policy termination by mail from your life insurance provider. If they do not provide this, you can request that you receive confirmation of policy termination.

What is cash surrender value?

Cash surrender value is the amount of money that accrues within certain policy types and is returned to the policyowner when they surrender a life insurance policy. The cash surrender value typically totals the cash value minus any fees, loans, or outstanding premiums owed.

Cash surrender value vs cash value?

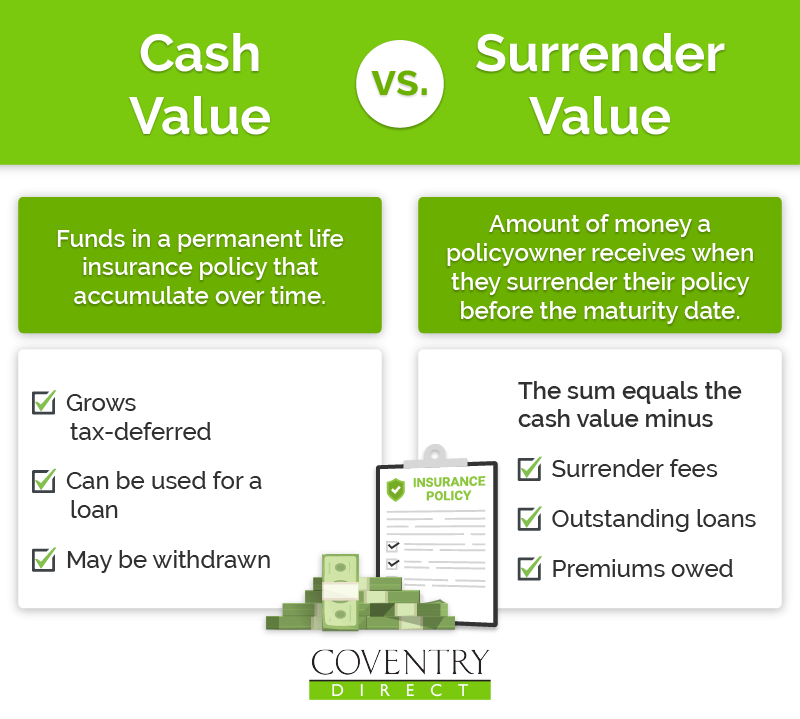

While many assume the surrender value means the same thing as cash value when talking about life insurance, they’re actually two different things.

Cash value is the amount of money that accumulates over time in a permanent life insurance policy. It grows tax-deferred and can be accessed via loan or withdrawal.

Surrender value, however, is the amount of money that will actually be returned to you upon surrendering the policy. This payout amount includes the cash value minus any fees, loans, or premiums owed.

What are the consequences of surrendering a life insurance policy?

There are a few consequences of surrendering your life insurance policy. First, you’ll no longer have life insurance coverage. If you die, your beneficiaries will no longer receive the death benefit from your life insurance since the policy is no longer in effect. Second, surrendering the policy can come at a financial loss. The cash surrender value is often lower than the total premiums paid, so you’re not extracting as much value from the policy as you paid into it. Plus, you may be responsible for paying surrender fees. Finally, you may find yourself with a tax bill if you have an outstanding loan from the policy. It’s better to pay off any debts owed to the policy before surrendering it.

Will surrendering my life insurance policy have any tax implications?

Surrendering your life insurance policy could result in a tax bill. The amount of premiums paid into the policy is called your tax basis and is considered tax-free. However, if you receive any gains over and above your tax basis, then that amount may be taxed as ordinary income. We recommend that you speak with your tax or financial advisor before making any major financial decisions.

An alternative to surrendering your policy: sell it for cash

If you’re looking for a way to receive more money from your life insurance policy, you may want to consider selling it in a life settlement. A life settlement pays, on average, four times the cash surrender value. Here’s how a life settlement works: you sell your policy to a third-party buyer, typically a licensed life settlement provider. They pay you a lump-sum for your policy, take over ownership and premium payments, and receive the death benefit.

There are a few things to consider if you decide to explore a life settlement:

- There’s a qualification process. Folks who have a policy that’s worth $100,000 or more may qualify to sell their life insurance policy.

- You can sell all — or some — of your policy. Some policyowners want to sell their entire policy while others want to retain a portion of the death benefit for their beneficiaries (also known as a retained death benefit). This option enables you to sell a portion of your policy while retaining some coverage with no future premium obligations.

- Terminally ill folks may qualify for a viatical settlement. Insured’s with a terminal or chronic illness can qualify for a viatical settlement instead of a life settlement. Viatical settlements tend to have a higher payout and can be used toward medical care and living expenses. They’re also generally tax-advantaged.

If you’re interested in exploring a viatical or life settlement, contact Coventry Direct to find out how much your policy may be worth.

Know your options with Coventry Direct

No matter what you decide to do with your life insurance policy, remember that your policy is exactly that: YOUR policy. It’s an asset you own and one that you’ve paid into for years. If it’s no longer serving you the way you want, it may be time to adjust your life insurance strategy by surrendering or selling your policy. Reach out to the experts at Coventry Direct to learn more about your options. Coventry can evaluate your policy to determine if it qualifies, giving you one more piece of information to consider before making a decision about what to do with your life insurance policy. Contact us today to learn more and get started.

Common Questions about Surrendering a Life Insurance Policy

Surrendering a life insurance policy can raise a lot of questions—especially around what you’ll receive, what fees or taxes may apply, and how the process works. Whether you’re considering surrendering life insurance policy coverage for financial reasons or simply no longer need it, understanding the basics can help you make a more informed decision. In the following sections, we’ll cover the most common concerns, from potential cash value payouts to tax implications.

What are surrender fees?

Surrender fees are charges that insurers deduct when a policyholder chooses to cancel their life insurance policy early. These fees can significantly reduce the cash surrender value a person receives from the policy.

What is a surrender period?

The surrender period is the initial number of years during which canceling a policy results in surrender charges. This period varies by insurer and policy type but typically lasts between 5 to 10 years.

Surrendering in a Term Life Insurance vs. Permanent Life Insurance policy, what’s the difference?

Term life insurance provides coverage for a set number of years and does not accumulate any cash value, meaning there’s nothing to collect if you surrender (i.e. cancel) it. Permanent life insurance, however, features higher premiums, includes a cash value component, and comes in types like whole life, universal life, and variable life insurance. When you surrender a permanent life insurance policy, there may be surrender value you can receive from it.

What is a lump sum payment for the value of a life insurance policy?

When surrendering life insurance policy coverage, policyholders may receive a lump sum payment equal to the remaining cash value, after fees. This is typically a one-time payout instead of structured installments.

Including these additional points will provide a more rounded understanding of the various factors and alternatives related to surrendering a life insurance policy, ultimately enhancing the user experience and potentially increasing the page’s visibility and relevance in search results.