Retirement is a significant milestone in a person’s life, signaling the transition from the workforce to a new chapter of rest and relaxation. However, some states are more ready to retire and live a life of leisure than others.

We surveyed Americans of all ages across the country to uncover retirement preferences in the U.S. Read on to find out how wide the gap between your state’s ideal and expected retirement ages is here.

When Do People Want to Retire?

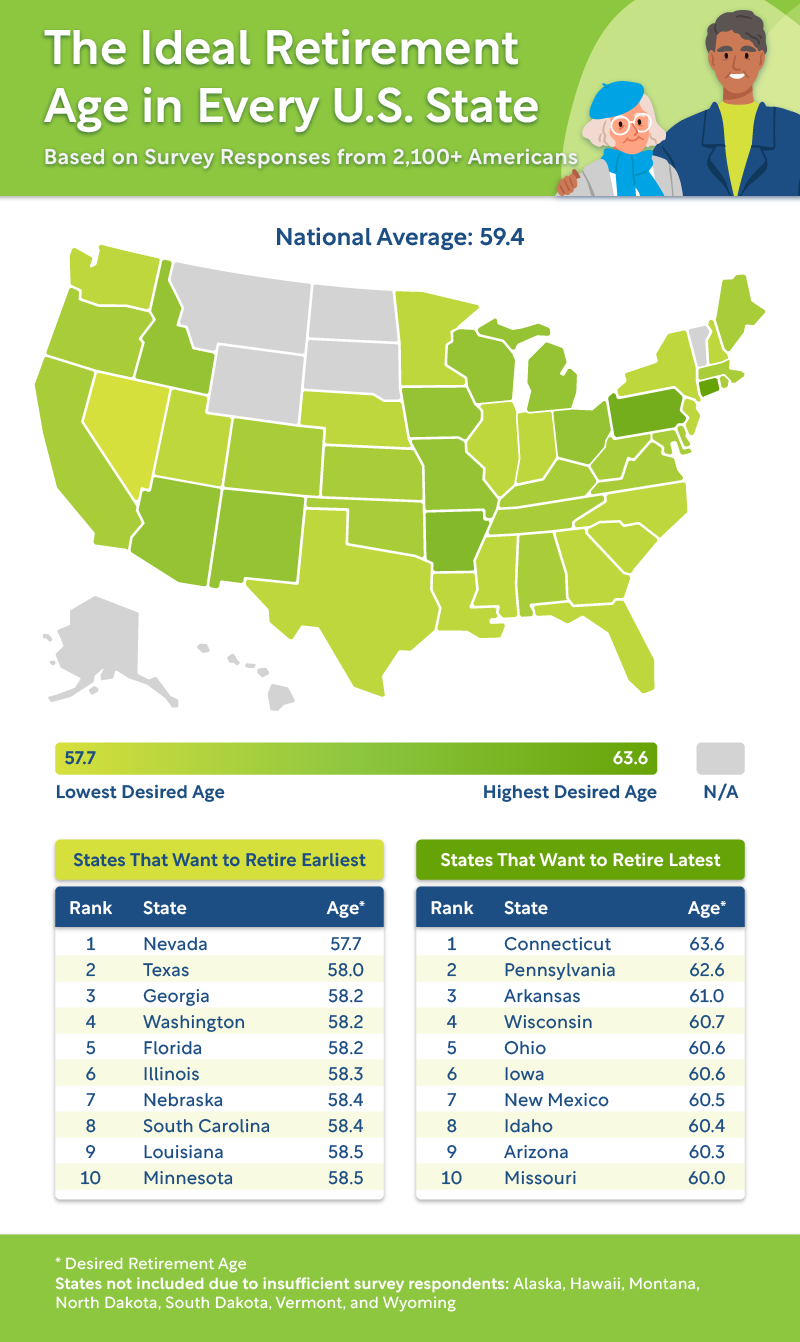

According to our survey, America’s ideal retirement age stands at 59.4 years, meaning that individuals are seeking to exit the workforce in their late 50s or early 60s on average.

However, there are a handful of states with workaholics whose aspirations include a later retirement. Connecticut takes the lead among them, boasting an average ideal retirement age of 63.6 years.

Pennsylvania, Arkansas, and Wisconsin residents follow close behind, each saying they want to retire around age 61. Many individuals choose to retire later in life to ensure they have enough savings and financial stability to support their retirement years. By continuing to work and save, they can build up their retirement funds and have a more comfortable lifestyle in their golden years.

On the other end of the spectrum, Nevada emerges as the state where individuals aspire to retire as soon as possible, with an average ideal retirement age of 57.7 years. Nevadans appear eager to exit from the workforce earlier, potentially influenced by lifestyle choices, priorities, and the desire to enjoy the benefits of retirement sooner.

Similarly, Texas, Georgia, and Washington residents are ready to step away from their careers around age 58. Ultimately, while retiring younger requires careful financial planning and consideration of one’s long-term goals and aspirations, it’s a goal for Americans from coast to coast.

Analyzing Retirement Perceptions Around the U.S.

Our survey reveals a discrepancy between the desired retirement age and the expected retirement age among respondents. On average, individuals say they want to retire at 59 years, while their anticipated retirement age is closer to 67.

This nearly eight-year gap indicates that many Americans expect to work longer than they initially anticipated, possibly due to financial considerations, changes in the job market, or external factors.

Examining retirement age preferences across different generations, we found that Gen Z, the youngest generation surveyed, expressed the desire to retire the soonest, at an average age of 57. On the other hand, Baby Boomers, the oldest generation, indicate they would prefer to retire later, with an average age of 65.

However, when it comes to the anticipated retirement age, we found that it was consistent across generations. On average, respondents from all age groups expect to retire between the ages of 65 and 68. Millennials anticipate the lengthiest working lives, with an average expected retirement age of 68.

In contrast, Baby Boomers anticipate the earliest retirement, projecting to retire at an average age of 66.

The survey findings also shed light on gender differences in retirement age preferences. Women, on average, expressed a desire to retire approximately half a year later than men. Conversely, men expect to retire about half a year later than women.

Examining retirement expectations — in comparison to their desires — at the state level offers additional insights. We found that Rhode Islanders have the least realistic retirement expectations, with the widest gap between desired and expected retirement ages (12.5 years).

Rhode Island also ranks among the top 20% of states in terms of the recommended amount of savings needed for retirement, indicating a potential disconnect between retirement aspirations and financial readiness.

In contrast, California presents a unique dynamic. Despite having the second-highest recommended retirement savings amount, the state boasts the most realistic retirement expectations. Californians demonstrate a balanced approach, aligning their aspirations with the financial preparations required for retirement.

Full Dataset

Are you curious to see where your state falls when it comes to retirement? Check out the interactive map above to see your state’s ideal and expected retirement age.

Closing Thoughts

From Connecticut’s desire for an extended career to Nevada’s yearning for early retirement, each state adds its unique hue to the canvas of retirement aspirations. Factors like financial readiness, personal goals, and regional influences shape individuals’ ideal retirement ages, emphasizing the importance of informed decision-making.

As dreams meet the practicalities of retirement planning, Coventry Direct can step in to offer valuable support. At Coventry, we specialize in helping seniors sell their life insurance policies, providing a financial resource to bridge the gap between retirement dreams and financial realities. With a life settlement, you can unlock the hidden value within your policy and secure the means to retire on your terms.

Coventry Direct stands ready to guide seniors through this journey, offering expertise and empowering them to access funds that can fuel their retirement adventures. With our support, seniors can confidently navigate the intricacies of retirement planning, transforming their aspirations into tangible opportunities. Contact us today for more information on how to get started.

Methodology

In order to identify the ideal retirement age in every state, we surveyed 2,151 Americans questions about when they want to retire, when they think they’ll retire, and when people should retire. The following states were omitted due to insufficient sample sizes: Alaska, Hawaii, Montana, North Dakota, South Dakota, Vermont, and Wyoming.

We also compared these insights to suggested savings needed to retire in every state, according to GoBankingRates.