People work their entire lives, looking forward to a comfortable retirement. But what happens when your retirement income fails to cover the cost of your expenses? When seniors find themselves struggling financially in their retirement years, the consequences can be intense stress and strain on both the senior and their relationships; seniors and their loved ones can be left worrying what options are available to them. Fortunately, many seniors don’t realize they possess an asset that offers high returns and can be quickly monetized when they need fast access to cash: a life insurance policy.

Not only does life insurance contain hidden cash value, it also offers many flexible methods for unlocking the policy’s worth. To kick off your exploration of this attractive financing solution, this post covers the ins and outs of cashing out life insurance policies, including the different cash-out options, their various tax implications, and criteria for eligibility. Discover how you can gain peace of mind by accessing the cash in a life insurance policy.

What Does it Mean to Cash Out A Life Insurance Policy?

Before we get into the many methods of cashing out life insurance policies before death, let’s cover a quick overview of what it means to “cash out” life insurance. Cashing out life insurance simply means using a portion or all of a policy to access a cash sum before the insured person’s death.

When you pursue the option to cash out, your policy’s accumulated cash value determines the size of the cash sum you can access. Permanent life insurance policies, including whole life and universal life insurance, can gather value over time called the cash surrender value. People often cash in their life insurance when they have high cash surrender values attached to their policies. However, there are ways that owners of life insurance policies that don’t accumulate a cash surrender value can cash in their policies.

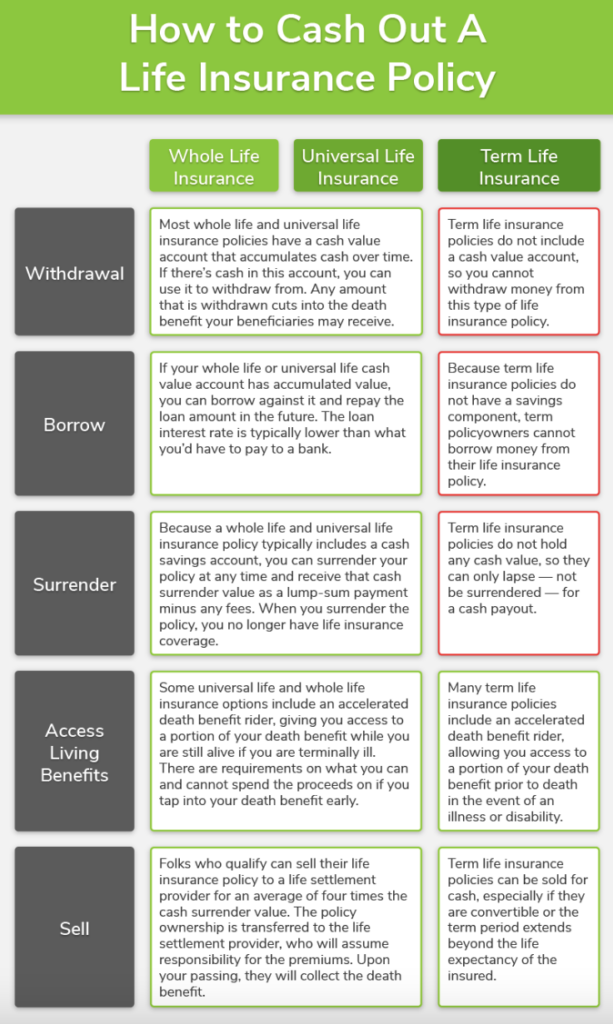

How to Cash Out A Life Insurance Policy

If you’re interested in cashing out a life insurance policy, there are several ways to access your money. Generally speaking, there are a few different ways to cash out your life insurance policy before death:

- Withdrawing money from your policy’s cash value account.

- Borrowing money from your policy’s cash value account.

- Surrendering your policy and receiving the cash surrender value.

- Taking living benefits from your policy.

- Selling your policy in a life settlement.

Withdrawing Cash From a Cash Value Account

Permanent life insurance, like whole life and universal life policies, have a cash value account for investing and savings purposes. If your policy has accumulated cash within that account, you can likely tap into it and extract cash to use now. Any money you withdraw from your cash value account will not be included in the death benefit that your beneficiaries receive. Term life insurance policies do not have a cash value account, so Term policyowners are unable to tap into a life insurance savings account.

Taking a Loan From Your Cash Value

If your Whole Life or Universal Life insurance policy has cash available in the cash value account, you can take out a loan against that amount for a much lower interest rate than a bank would provide. When you borrow money from your life insurance policy, you need to pay it back in order to prevent a lapse in the policy. Term policyowners are unable to borrow against their life insurance policy because their policy structure does not include a cash value account.

Surrendering Your Policy

If you want to cash in your policy altogether to receive a cash payout and stop premium payments, you can surrender the policy and receive the cash surrender value. This is only available to people with Whole Life or Universal Life insurance policies that have accumulated money in their cash value account. People with Term Life insurance policies are unable to surrender their policy because it does not accumulate any cash value over time. Term policyowners can lapse their policy without a cash payout.

Accessing Living Benefits From Your Policy

If you are terminally ill and your life insurance policy includes an accelerated death benefit, you could gain access to a small portion of the death benefit to pay for medical expenses. You may want to evaluate whether accessing living benefits or selling the policy in a viatical or life settlement would garner you a higher payout. Oftentimes selling your policy to a third-party may earn you more cash than tapping into the living benefit your insurance provides.

Living benefits allow seniors to cash in a percentage of their policy’s worth to put towards healthcare expenses tax-free and without ending their coverage. The benefits cap can often be as high as 50% of the policy’s cash value. If you think you might qualify for living benefits, calling your insurance company is a great way to learn more about eligibility and the policy’s cash-out limits.

Selling Your Policy

Folks with a Whole Life, Universal Life, and Term Life insurance policy could qualify to sell their policy in a life settlement and receive, on average, four times the cash surrender value. When it comes to how to sell your life insurance, you can sell your policy to a life settlement provider and receive a one-time cash payment. The life settlement provider takes over premium payments and receives the death benefit when you pass away.

If you are terminally ill or chronically ill, you may be able to cash out your life insurance policy and use the proceeds to pay for medical costs. This type of sale is called a viatical settlement and it tends to have stricter guidelines around who may sell their policy and what the proceeds may be used for.

Can You Cash Out A Life Insurance Policy While Still Alive?

Yes, there are a few ways to cash out a life insurance policy while you’re still alive. Though a life insurance policy usually releases its cash value by providing death benefits to the insured person’s beneficiaries, you can also access its value while the insured person is still alive. In fact, there are several methods of cashing in life insurance policies before death such as withdrawing funds from the policy’s account, taking out a loan on the policy, surrendering the policy, or even selling the policy in a life settlement.

Some seniors may also qualify for an additional cash-out method called living benefits which provides funds to those who meet certain health criteria. Most often, eligible candidates have a chronic illness, require long-term care, or are terminally ill. If you fall into any of these categories, you can call your insurance company to get more information about the terms of eligibility and the range of living benefits available.

When Can You Cash Out A Life Insurance Policy?

If you’re considering cashing in your life insurance policy, a question you may have is, “when can I cash out my policy?” When it comes to accessing cash from your policy today —rather than after death —there are a few things you’ll need to consider:

- You need cash accumulated in your policy’s cash value account. It can take years to accumulate enough cash in your cash value account to borrow or withdraw from. There’s typically no required time span limiting you from borrowing or withdrawing cash; rather your account needs time to accumulate enough cash to satisfy the draw.

- Your health determines when you can access living benefits. You can cash out your life insurance policy’s living benefits when you are terminally or chronically ill.

- States requirements vary in length of ownership before you can sell your policy. To protect seniors from predatory buyers, most states legally require ownership of a policy for two to five to ten years before a policyowner can sell a life insurance policy to a third-party buyer. If you want to sell your life insurance policy, find out if you’re qualified and see how much your policy may be worth in a sale.

Can A Term Life Insurance Policy Be Cashed Out?

Some life insurance policies, namely term life insurance, do not collect cash surrender value. However, this doesn’t mean you can’t access the cash value of your term life insurance.

Whereas you can easily monetize a permanent life insurance policy through withdrawals, loans, or cash surrenders, owners of term life insurance must follow a slightly different path to cashing out their policy. If a policyowner has a “convertible term life insurance” policy, they can transform their term policy into a permanent policy. Once the transition is complete, they can then cash out their policy through the above mentioned methods.

Even if policyowners do not have a convertible policy, they can still access their term policy’s cash value. Through a process called a life settlement, term life insurance policies can be sold for cash—ending the holder’s obligation to pay premiums and offering a significant payout.

Are there tax consequences for cashing in life insurance?

When considering a new financing solution, tax obligations are often top of mind. Fortunately, the tax implications for extracting cash from your life insurance can be quite moderate, depending on which method you select. Examine the following tax consequences of cashing in your life insurance policy for each option.

Withdrawals: Withdrawals from active life insurance policies are not subject to taxation unless at least one of the following conditions are met: it has been under fifteen years since the beginning of the policy or the policy is an MEC. In these cases, withdrawals are taxed as income.

Loans: As long as the senior’s life insurance policy is not considered an MEC, policy loans are not taxed.

Cash Surrender: Any cash gains seniors receive from a cash surrender is taxed as ordinary income.

Living Benefits: For those with declining health who qualify for living benefits, typically you do not have to pay taxes on the cash benefits you receive.

Life Settlements: Unless the settlement payout is greater than the policy’s tax bases, all of the proceeds seniors receive from a life settlement are tax-free. To see what happens when your payout exceeds the amount of paid premiums, learn more about the full life settlement tax consequences in this comprehensive review.

Coventry Direct does not offer tax or legal advice. This material has been prepared for informational purposes only and should not be relied upon for tax or legal advice. Coventry Direct urges you to consult with your own tax or legal advisors before entering into any transaction.

The Pros and Cons of Cashing Out a Life Insurance Policy

Cashing out a life insurance policy to use funds now certainly has its pros and cons. Evaluate the list of benefits and disadvantages of cashing in your life insurance policy before death.

The pros of cashing out your life insurance policy while you’re still living:

- Immediately use funds for current living expenses. Whether you need cash for retirement, healthcare expenses, long-term care, or something else altogether, you can tap into an asset you’ve been paying into for years.

- Stop paying premiums if you surrender or sell your policy. In addition to getting the proceeds of the surrender or sale of your life insurance policy, you also stop paying costly premiums.

- No impact on credit score. Cashing in your life insurance policy does not affect your credit score since it is not a loan or line of credit.

- Consolidate debt. Taking out a loan against your life insurance policy can be a way to consolidate debt and lower your interest rates.

The cons of cashing in your life insurance policy before death:

- Lower — or zero — death benefit for your beneficiaries. Cashing in your life insurance policy can result in a lower payout — or none at all —to your beneficiaries.

- Potential tax consequences. You may need to pay taxes on the proceeds you receive when cashing in your life insurance policy, especially if the policy’s cash value exceeds the total amount of premiums paid.

- Loss of life insurance coverage. When you cash in your life insurance policy, you may no longer have coverage for your loved ones, which means you’ll need to find another way to protect your loved ones in the future if they’re still dependent on you.

- Possible penalty fees. If you surrender your policy or withdraw cash from the cash value account before a certain period, you may have to pay penalties or surrender charges.

Is It Worth Cashing In My Life Insurance Policy?

The truth is, only you can decide what the best path forward is given your circumstances. Since every person’s financial and personal situations are unique, no one can decide for you whether cashing in your life insurance policy is worth it or not. The best way to weigh your individual pros and cons is to meet with a qualified financial advisor. They can provide neutral, knowledgeable advice on how to maximize your financial interests with your life insurance policy.

Contact Coventry Direct for More Information

Are you considering cashing in a life insurance policy? Whether you decide to withdraw, borrow, surrender, or sell your policy, it never hurts to find out how much your policy may be worth in a life settlement. Reach out to an expert at Coventry Direct to understand how much you could receive in life settlement proceeds. The more information you have, the better you can make an informed decision about cashing out your life insurance policy. Reach out today for an easy, obligation-free educational call: 1-800-268-3687.